view in browser

Watching the billionaires wrestle for top spot makes extreme wealth seem so… run-of-the-mill (or is that bill?) these days. Do they even sweat about $9 billion evaporating overnight? Now, I'm the last person to tell you to think small, but here's why we should go wide instead of big…

Today in 10 minutes or less you'll learn:

- Why you're even less like Zuckerberg than you thought

- The horrible truth about lightning, sharks, and, yes, billionaires

- Why being passive actually stops you from becoming a loser

- Your real opportunity for financial freedom

MENTAL FRAMEWORK

The Truth Most People Won't Tell You

It is capital D DUMB to focus only on one thing ever and not diversify your earnings.

Why?

Because most of us, including me, are not Zuckerberg and never will be. Let that soak in for a moment. You and I will most likely never be billionaires. Oddly, I feel fine about it. It's highly unlikely that I'll become one, even if I'm worth eight or nine figures right now. Why? Let's use math, not feelings.

Because it's the holidays and I'm feeling froggy, at the end I'll tell you how I have more like a 70-90% chance of absolute financial freedom without the almost 100% chance of losing everything.

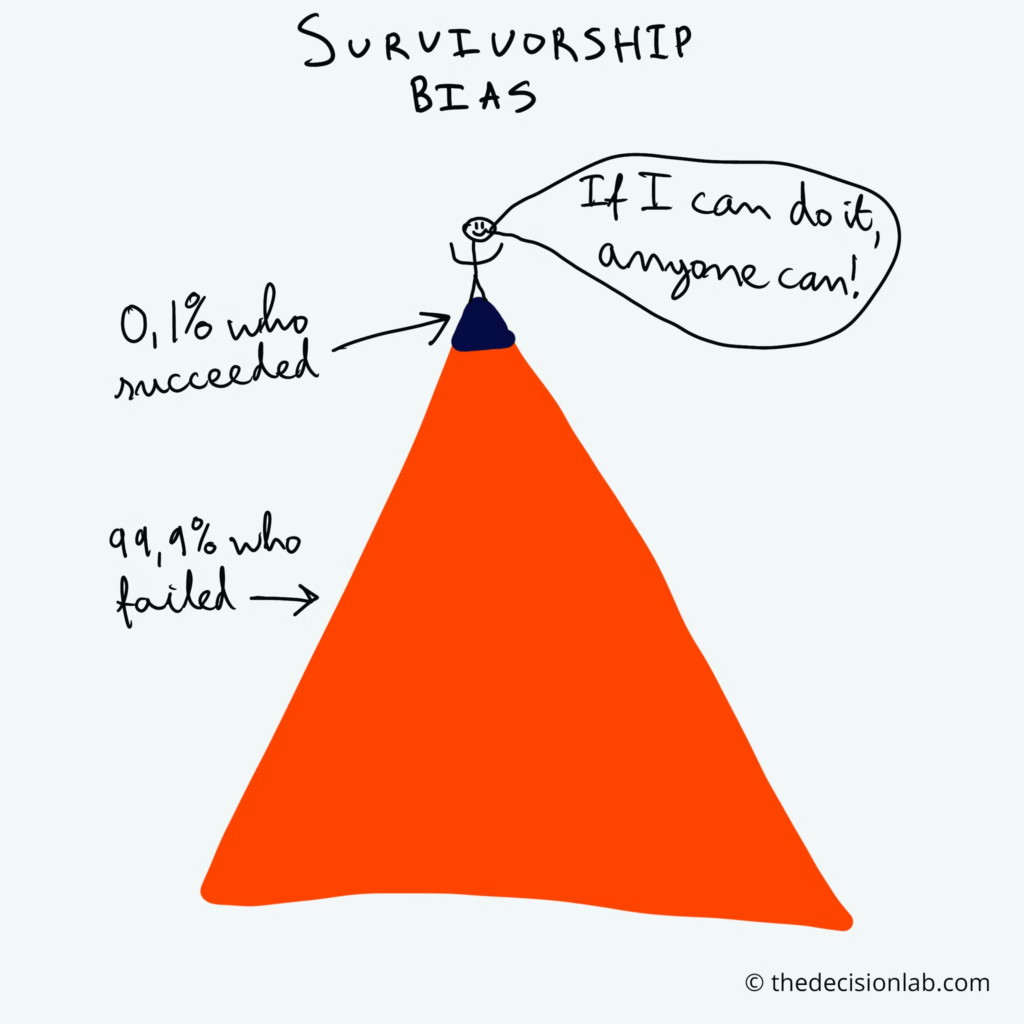

First, an important term: survivorship bias.

This is a cognitive shortcut that happens when a group of people who succeed are mistaken as the entire group because those who didn't survive aren't visible.

Here's how this plays out in finance. Successful entrepreneur #1 says… I made money so everyone will make tons of money. EVERYONE who is guru-ing you online has a bias… they've probably made millions. They're smart. They got lucky maybe. They survived. But you're WAYYYY less likely to hear the other 2,000 stories from the people who went all in, got their teeth kicked in, and never made it.

Let's Do Billionaire Math…

There are 2,668 billionaires in the world. About 500 more are created each year, although some drop off. There are 7.97 billion people in the world.

So, you have about a 0.0000345% chance of becoming a billionaire.

Let's put this into context, shall we?

You have a 0.46% chance of dying from falling.

7,200 people have been bitten by sharks in the last 80 years, so you're more likely to get bit by a shark than become a billionaire.

You have a 1 in 12,000 chance of being struck by lightning.

The odds of being killed by an asteroid impact? 1 in 74,817,414, or 0.00000134% (ok, so maybe becoming a billionaire is more likely than the next Armageddon…).

But hell, 1,600 people win the lottery every year. That's more than three times the number of billionaires created. And, my friends… how many of you think the lottery is good odds?

Favorite quote: the lottery is a tax on people who can't do statistics. Your odds are not great.

Oh, and according to CNBC only 44.6% of billionaires are self-made. So, we actually only have a 0.0000155% chance of becoming a billionaire.

That's just the truth and the math.

YOUR TRUE POTENTIAL IS STILL UNTAPPED

First, Don't Be Such a Loser

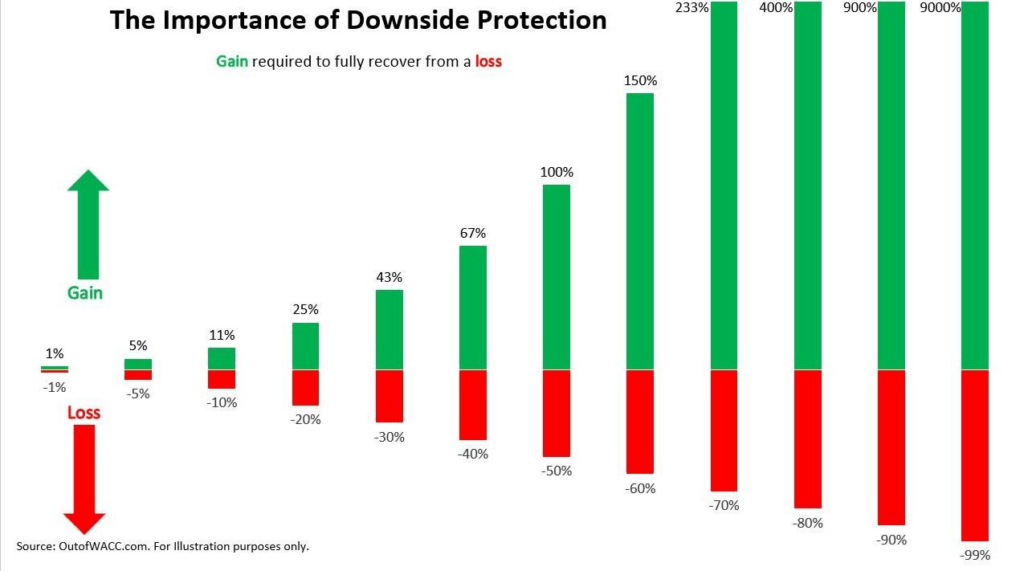

What does this mean for you? It isn't sexy, but there is massive power in what is called downside protection.

Since we know losses compound, we take risks to decrease the likelihood of losing. Ask yourself this question:

Would you rather lose everything you have to potentially make $1m or have a high chance of keeping what you have and the potential to only make $100k?

Most people will take the latter.

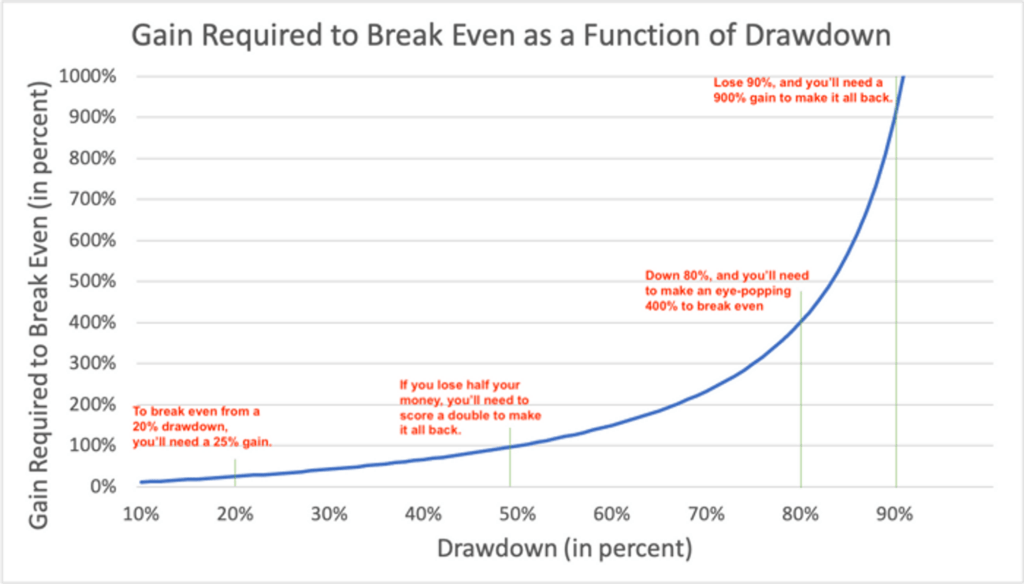

That is smart because let's say you lose 20% in the stock market. You don't have to just make back 20%. You have to make back more because the amount you have available to invest in now less. What you have left must earn more to make up for what has been lost.

Here's how it works… breaking even from a 10% loss requires an 11.1% gain. Recovering from a 20% drawdown requires a 25% gain.

To break even from a 50% loss, you need to double your portfolio from the bottom. Lose 75% of your bankroll, and you need to make 300% in order to break even.

This simple yet sobering reality means that the gain required to break even from a loss (of any size) is always larger than the loss itself. Put another way, drawdowns that deepen by every additional 1% require a subsequent gain of more than 1% to achieve break even.

As a result, very substantial losses become nearly insurmountable—but only nearly.

This is why smart people do this super boring thing everyone likes to make fun of called diversification.

There are virtually endless was to create passive or new income streams, even despite the recession.

And the easiest way to start is to select 1 of them and go for it.

So, I selected my top 11 ways to create new cashflow and built a playbook on how to do it.

Check them out, find the 1 idea that sets off a spark in you, and start off 2023 with a new income stream.

BORING OR NOT... TRUST THE MATH

Your Net Worth Today and Tomorrow

The reality is that total household debt rose a record 6.3% this past year, a major factor of the nearly $7 trillion (yes, trillion with a T) net worth LOSS felt by American families mostly because of the 2022 stock market swoon. Ya, it hit me too. But if you're one of the retail investors whose only parking spot for money is the stock market… that loss hits pretty hard.

This is why you need multiple passive income streams. Because the truth is you are statistically more likely to only have $300 in savings than you are to be a billionaire.

40% of Americans or 131 MILLION people only have $300 in savings right now.

Now, my friend, are you the one, the only, the super duper future billionaire? I f*cking hope so.

BUT LET ME TELL YOU WHAT… I'd rather be wrong that you are a billionaire in the making, and you crush it, than tell you to go all in with the much higher likelihood that you end up eating ramen in your mom's basement.

Also fun fact: apparently half of 18-29-year-olds live at home still. Wow.

The key hallmark of success is that you look at the TRUTH, the NUMBERS, the FACTS and you do the hard things, anyway. But you hedge your mother f'ing bets.

That's probably why 7% of the Forbes 100 list is comprised of yes… hedge fund managers who are worth more than $220 billion. They protect their downside for a living. I sit on the board of a hedge fund with $6.5 billion in assets. These guys are geniuses and how many of them have just one position in their portfolio?

ZERO!

Because they know the truth… that even John Paulson, with billions under management, has 24 positions. The average PE firm has over 60 positions.

Oh my lanta, do I get worked up over this stuff. But I keep seeing people telling others to burn the bridges. Do not burn the bridge. Build an airplane so you never have to use it.

OK, so now that I've crushed your billionaire dreams…

BTW, that's silly. Think about it:

Do you really want to work as many hours as this guy?

Do you really want to have a gnarly divorce like this guy?

Or have to defend accusations like Bill Gates?

Or become like the Gore-Tex family who all sued each other over their grandparents' money?

IDK, mo money, mo problems sometimes.

I've never really liked the Dorothy Parker quote:

"If you want to know what God thinks of money, just look at the people he gave it to."

But I do understand why she said it. Here's the difference:

Money as a tool is a superpower. Money as a mission is a disease.

So what do we do instead? How do we get rich without losing it all?

We Diversify

We take hundreds of small bets continuously throughout our lives and we make our money work for us.

That is why I own 26 businesses. Could I be a billionaire if I focused on one thing only? Maybe. But I came from a family who had nothing. I didn't know anything about math or finance when I started, and I built up a net worth that includes more zeros than I would have imagined.

AND I never had to sleep on my couch, be horrified that I'd run out of money the next day, or not be able to pay my bills.

Because I had it easy? No, I worked 2-3 jobs for a long time. Because I didn't listen to all the hardos telling me you have to go all in or you're out. Now I'm worth more than them and I still got to, you know, see my family and watch Netflix.

So yes, it's boring but…

- Invest while you're earning

- Keep working while you build your side income

- Take some investor money so yours isn't always the only skin in the game

Keep some chips in your pocket. When someone says you don't need more than one income stream, just ask them if they understand math. Or throw the term "compound losses" at 'em, you smarty pants.

XOXO,

Written by Codie 'Boots over suits' Sanchez and Nikki 'I'll sleep when I'm dead' Byrd

CONTRARIAN EXTRAS

The Not So Boring Section:

⚖ Survivorship bias? Check out another 24 mental tilts we succumb to (including the curse of knowledge 😳)

🎬 $From $300 to celebrity millions…Movie stars get it. They diversify…

🚘 Elon vs. Bernard… when a few billion is pocket change, right?

Don't miss this one...

Want to know the safest business you can start with $0 that can make you millions of dollars?

It's a business that makes me 7 figures a year and yet, NO ONE is talking about it.

Y'all should check out our YouTube today to find out...

What Did You Think of This Week's Newsletter?

💲💲💲💲💲F*cking Killer

💲💲💲Meh

💲Do Better

Disclaimer – This is the "Be an adult" section. Everything mentioned above isn't advice, just a recount of what I did. That said: This article is presented for informational purposes only. The opinions stated here are not intended to recommend any investment or provide tax advice. Neither are they an offer to sell or the solicitation of an offer to purchase an interest in any current or future investment vehicle managed or sponsored by Codie Ventures, LLC or its affiliates. All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. Day trading and investing do involve risk, so caution must always be utilized. We cannot guarantee profits or freedom from loss. You assume the entire cost and risk. You are solely responsible for making your own investment decisions. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. By reading/sharing this newsletter or consuming our content on our other channels, you are indicating your consent and agreement to our disclaimer.