| Is the Fed crashing the housing market… again? According to colleague Jeffrey Tucker, the answer is obvious: yes. We invited him to lay out his case below -- and show how he believes it could all play out. Before we go there… Another colleague, Jim Rickards, just "broke rank" with the Washington elite and released a pretty shocking video. It contains a 153 stock "kill list." If you own any, says Rickards, "Sell these stocks immediately, today if possible." If Jim's right about this list, I doubt anyone on Wall Street would want you to see this. That's why I'm sharing it here today. Because come tomorrow morning it could already be too late. Click here to see Jim's message now. And read on.

The Fed Is Crashing Housing, Again

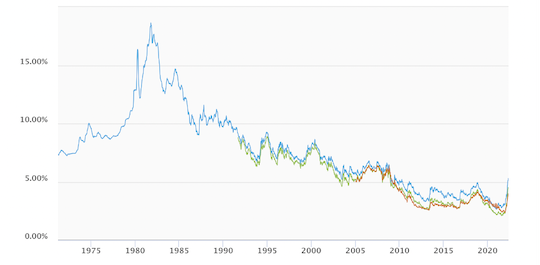

Jeffrey Tucker Back in 2007, the driving ethos was that the housing market could never, under any circumstances go down in total. Prices are entirely local and determined by supply and demand. This is why so many top minds in that year were very hard core: there is no bubble. All fundamentals are strong, they said. Then of course, everything fell apart, dragging financials down too. From which one might assume that we would learn. If the liabilities are bundled without regard to risk profiles, and traded as securities, then the housing market also becomes as vulnerable as any paper financial product. These days, however, it seems like this lesson wasn't a lesson at all. The Buyer of Last Resort After the epic crash, the Fed became the buyer and holder of trillions in refuse from the calamity. It has worked for a decade to clean up its balance sheet but never really succeeded for fear of causing recession. In February 2020, the Fed owned $1.4 trillion in mortgage-backed securities. It had every intention of dumping these out of its portfolio, thus dialing market liquidity it was providing to market. Then suddenly, the great virus arrived and Congress went wild with spending. Next thing you know, the Fed's portfolio of mortgage-backed securities ballooned to $2.7 trillion. They had gone shopping, paying with newly printed money. Wonder of wonders, the housing boom started all over again. It was history on repeat. Here we are, two years later, with a vastly more complicated problem. Inflation is soaring due mainly to the trillions in hot money dumped all over the country to subsidize lockdowns. Supply chain breakages make that worse. The forced recession of March and April 2020 never really went away. All that has changed is the ability of the federal government to cover it up. Now the numbers are starting to reflect reality, and a recession is upon us. In the middle of this mix of inflation plus recession, we could experience something new: a housing demand-based bust in the middle of a period of high inflation! Thirty-year rates rose above 5% in April for the first time in ten years. Here is a ten year chart.  This small change (there is nothing at all unreasonable about 5% in 30 years) has caused a huge and sudden change in mortgage applications and the drive to build more and more. Here is the same chart in the context of 1970 to the present. If we really are going back to the 1970s, there is a long way to go before reaching a historically justified equilibrium.  Mortgage applications have already declined 12%. They are 15% lower than the same time last year. Keep in mind, too, that housing prices are up 20% year-over-year, which makes small changes in the rate extremely meaningful for financial decisions. Let's say there is a housing bust, even a dramatic one. How does that play out in an environment of very high inflation for everything else? It all depends on how one weighs the housing sector in the construction of the index. It could drag it down for sure but not eliminate it. In any case, we are nowhere near that point: housing plus utilities inflation is right now still running 12.1%. It's likely that the next housing bust will take a different form: dramatically declining demand in the context of ever higher prices. |

No comments:

Post a Comment